Over 37% EMEA businesses suffer from travel and expenses fraud, new research from SAS reveals. Other types of financial crime and errors facing companies from the region include contract bid rigging (over 25%), duplicate invoicing (27%) and frauds committed by employees using company credit cards (22%). Even though frauds are a major issue, businesses struggle to tackle procurement and occupational fraud using outdated manual controls and rule-based software detection.

Procurement fraud occurs when employees and suppliers behave fraudulently during contract bidding process or over the course of the contract. This can range from employees colluding with their preferred vendor to give unfair advantage during procurement, to suppliers submitting multiple invoices for a single item or service. While procurement fraud is a serious crime that in many countries carries a jail sentence in many countries, perpetrators are often willing to take the risk for personal revenge or financial gain.

Real numbers

Financial losses caused by frauds and processing errors are no longer hypothetical numbers. SAS research reveals that over ¼ of EMEA companies lose between 10 000 and 150 000 € every year. 18% reported up to 10 000 € losses annually and almost 12% reported between 150 000 and 400 000 € losses annually. Over 400 000 € losses have been detected by 3,7% respondents.

“These figures are only the tip of the iceberg” said Laurent Colombant, Continuous Compliance and Fraud Manager at SAS. “Procurement fraud is notoriously difficult to detect and measure. This is due to a lack of preparedness and awareness, as well as its bugbear status, among businesses. As a result, the true scale of the challenge is most certainly underestimated”.

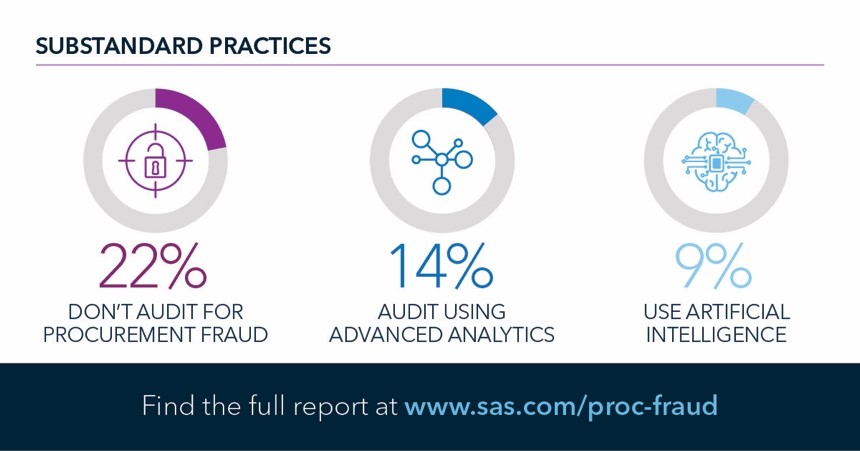

Lack of effective fraud detection methods and procedures is an important issue. Companies often do not know how much money they are losing – almost 17% answers in SAS research. Other 24% believe that those are negligible losses. This suggests a little awareness of the damage inflicted by procurement fraud, even though almost 48% companies declare they perform regular internal audits.

Promising sign in battle against frauds

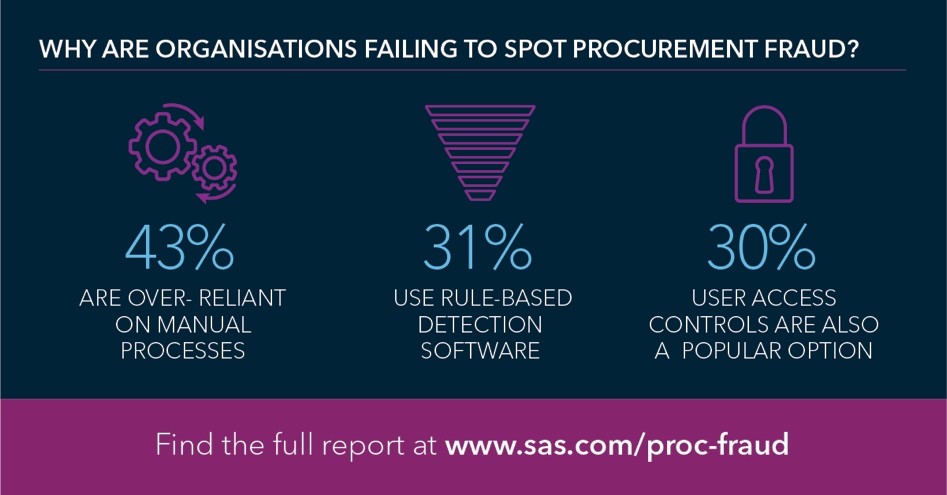

SAS experts emphasize that EMEA companies need to invest in better fraud detection mechanisms. SAS research shows that manual controls are the most popular form of monitoring procurement processes used to detect possible fraudulent cases for over 44% of respondents. Almost 30% validate procurement applications manually to minimize mistakes or fraud and 28% rely on staff to inform superior on any wrongdoings. Other most common detection techniques include rule-based software detection (almost 30%) and anomaly detection (over 28%).

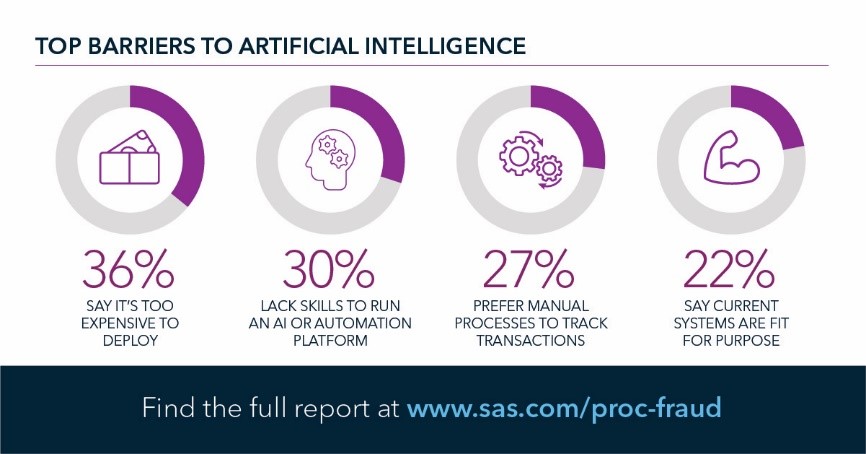

Even though methods mentioned above are highly ineffective the research shows promising sign – 28% respondents said they use data analytics to monitor for any possible mishaps and predict possible fraudulent cases. The main barriers to using advanced analytics as a preventive tool for procurement fraud or errors are: costs of deployment (32%), lack of skills (30%) and preference of manual processing (27%). Similar obstacles stop companies from implementing AI or automation as a preventive tool for procurement fraud or errors.

Trust in supplier network

Even if an organization has a tight anti-fraud internal system, financial crimes can be committed by supplier network representatives. That is why businesses need to focus more on companies they cooperate with. Only 22% of SAS research respondents monitor supplier network quarterly, almost 23% do it twice a year and close to 19% perform and audit once a year. 14% companies monitor suppliers ad hoc.

SAS research took place in 16 countries including: UK, France, Italy, Spain, Greece, Poland, Turkey and South Africa. Respondents were representing many different industries including: Information Technology, Engineering & Construction, Manufacturing, Education, Wholesale and retail.

For more information view the full report entitled Unmasking the enemy within: how smart analytics can stop procurement fraud.