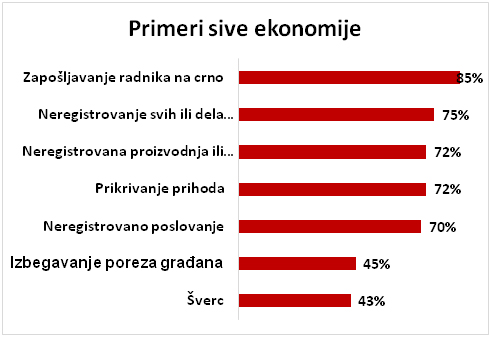

More than two-thirds of entrepreneurs in Serbia, or even 68% believe that the shadow economy declined in the past year, but they are convinced that 29% of firms in their industry operates in a grey zone, workers are not reported and companies do not pay the tax, according to a new research NALED on the attitudes of the economy of the shadow economy, as conducted by Ipsos Strategic Marketing.

– According to the assessment of the economy, the main reasons why unregistered companies were able to operate freely outside the law are corruption and confusion over the jurisdiction of inspectors, insufficient capacity of the country, political protection and inadequate penal policy – said the Ipsos researcher Vojislav Mihailović at the presentation of research at the Media Centre in Belgrade.

Three-quarters of those surveyed believe that the country is determined to fight the grey economy and to work outside regulations is not justified, which is considerably higher percentage than in previous research. On the other hand, not all businessmen are ready to actively join the struggle – 61% would not report unfair competition. They believe that the control of respect for the law is only business of the state (40% of responses) or do not believe that reporting would have any effect (24%).

Industry estimates that the grey economy is most common in the construction industry, commerce, the legal profession and the hospitality industry, as key causes of the shadow economy seen primarily in high taxes and contributions on salaries and para-fiscal charges.

State Secretary of the Ministry of State Administration and Local Self-Government Željko Ožegović said that campaign is already giving effects. The percentage of irregularities in the controls of invoice in February this year decreased from 40% to 32% compared to the same month last year, and there is 26.6% of conscientious citizens who reported non-issuing of receipts.

– Almost three million envelopes sent in February shows that on average every third citizen of our country turned into a prize draw and that we were able to attract a large part of Serbia, the problem of the informal economy and to raise the awareness of why it is important that every trader or owner of the premises who issues a fiscal receipt does so and that we all pay taxes – said Ožegović.

Jelena Ristić, director for markets of Serbia, Montenegro and Bosnia and Herzegovina in the company Mastercard, presented a survey on the attitudes of Serbian citizens towards grey economy.

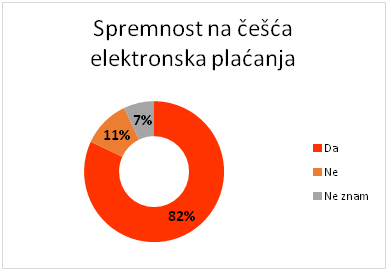

– The vast majority of citizens, 95% of them understand what is the informal economy, and this problem is usually associated with undeclared workers and undeclared payments to avoid taxes. About two-thirds of respondents believe that the increasing use of electronic payment is reducing the grey economy and the positive is that 82% of citizens are ready to pay more often to cashless contributed to solving this problem – said Ristić.

She stressed that the priority of payment cards in the fact that the transaction will be recorded even when the trader decides not to issue a fiscal receipt. For citizens and businesses, cashless payment means not only safety but also lower costs compared to the use of cash.