Our stance to always compete with ourselves and challenge our own capacities, while striving to be a better version of ourselves with each day, without looking back or aside, proved to be our recipe for success.

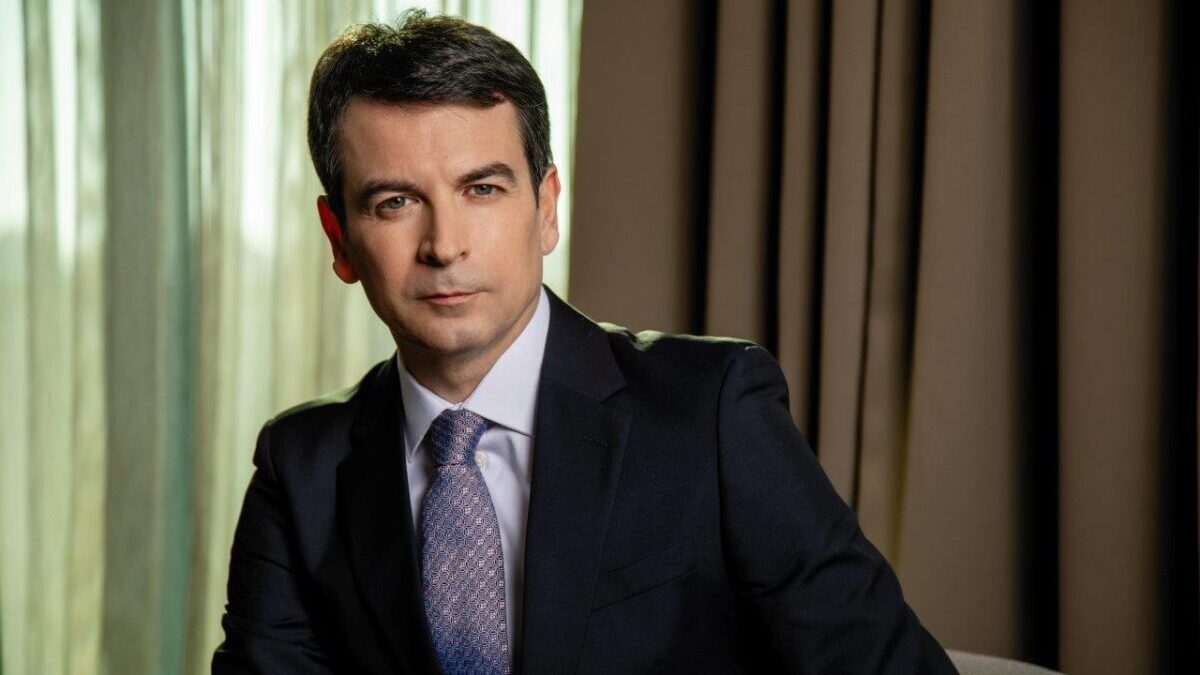

After serving as a long-time member of Banca Intesa Beograd’s Executive Board and now its President, we spoke with Darko Popović about further improvement of Banca Intesa’s business results, energy efficiency and keeping pace with new technologies and digitalization of the bank’s services.

Earlier this year, you were appointed President of the Executive Board of Banca Intesa in Serbia, but you were an Executive Board member for a long time before that. Do you plan to make changes in the bank’s operations or will you keep the same course set by your predecessors?

The opportunity to enhance my knowledge and professional experience, while shaping managerial and leadership skills in a complex and inspiring environment, such as Banca Intesa, part of Intesa Sanpaolo Group, is a combination of luck, dedication and hard work. My twenty-year-long journey across different divisions and being in various key positions in the bank, out of which thirteen years as a member of the Executive Board, led to me being included in all strategic decisions and gave me the capacity to devise a number of game-changing projects that were of utmost importance for Banca Intesa to hit significant business milestones and maintain its No. 1 position in the market throughout years. Having said that, it is impossible not to extend my true gratitude and appreciation to Mrs Draginja Djurić, who set the bank on a course of success and prosperity from the very beginning, wisely implementing affirmative local values and practices within internationally established frameworks and global standards.

We are aware that as the leading bank in Serbia we are an important part of the local community with a significant role in the lives of citizens and the economy, as well as the impact on the environment.

We will remain on the same path to support households and businesses in Serbia, backed by the global expertise of our parent Group that is largely contributing to our accomplishments and whose absolute support is resulting in the successful completion of strategic projects aimed at achieving better business results but also helping citizens and the economy. In the end, a healthy system and rightly set infrastructure certainly provide excellent preconditions for each new start and lay even better foundations for the accomplishment of plans.

Banca Intesa is the leader in all the most important banking segments in Serbia. How can the bank achieve even better results and what are your long term strategic plans?

For over fifteen years now, Banca Intesa has been at the forefront of the banking sector, boasting the largest market share in total net assets and loans, customer deposits and capital, while serving the largest customer base with 1.4 million customers. Relying on our extensive experience, I can confirm that the position of a market leader is a powerful one, but vulnerable at the same time since they are always under attack by followers and forced never to drop their guard. Our stance to always compete with ourselves and challenge our own capacities, while striving to be a better version of ourselves with each day, without looking back or aside, proved to be our recipe for success. I strongly believe that banking will have to evolve together with customers’ needs and expectations, shaped by the advancement of new technologies, which will have a significant impact on the balance sheets of banks in the future. This industry will have to explore the way of using technological achievements in order to think even beyond going digital but to use the full potential of data management in creating a holistic approach to customers, reshaping the role of banks in future.

Which core values, principles and policies the bank, as part of an international group, adheres to in its work?

Following the values of Intesa Sanpaolo, our parent company, we believe in the integrity and sustainability of our actions, caring for the customers through the excellence of our products and services to create value and build a future by fostering equal opportunities in an inclusive society. Taking care of what our clients care about the most, our mission is to continue bolstering positive values and boosting innovation to support the economic prosperity of the country, while accomplishing our own business results and at the same time pursuing the highest ethical principles.

In order to remain relevant and stay competitive in the market, banks will have to keep pace with the habits of their customers.

As a bank that employs over 3,000 people, we proudly advocate the culture of diversity and inclusion, at the same time promoting meritocracy and nurturing talents, which is reflected in the fact that we hire mostly in-house for the middle and high management positions.

Energy efficiency is a current topic in Serbia. Does Banca Intesa offer energy efficiency-related products?

While being determined to follow the example of its parent Group, Banca Intesa is committed to developing specialized products and services within innovative financial solutions in the field of circular economy to promote concepts of renewable energy and energy efficiency and encourage clients to reduce their environmental footprint. In 2021 alone, EUR 30.8 million were disbursed to the corporate sector and SMEs for projects aimed at rationalizing resource consumption and the use of biomass in production processes, as well as reducing CO2 emissions. In addition to this, under the umbrella initiative “Circle of sustainable ideas”, energy efficiency mortgage loans and consumer loans have been created, with more appealing and favourable conditions to induce the change in people’s behaviour. Furthermore, we plan to expand our “energy-efficient” offer to all customer segments with the launch of farming loans that would encourage this important switch to greener production in agriculture as well.

All successful companies in the world are focused on social responsibility. Does Banca Intesa support activities outside its main field of work?

We are aware that as the leading bank in Serbia we are an important part of the local community with a significant role in the lives of citizens and the economy, as well as the impact on the environment. That is why we are committed to achieving our business objectives in a way that ensures sustainability and takes into consideration the needs of all stakeholders. Belonging to an international banking group of Italian origin, it does not come as a surprise that we have always strived to contribute to the exchange of positive values between two countries by supporting sports and culture, especially in the young population. Throughout the last decade, Banca Intesa supported Italian football camps for children, promoted by great football legends coming to our country, such as Paolo Rossi, Roberto Baggio, Alessandro Del Piero, and Andrea Pirlo, thus spreading the notion of healthy habits, hard work, dedication and sports spirit among children. Moreover, we try every day to set an example to our employees and the overall public through our true dedication towards diversity and inclusion, “green thinking” in all our operations and also financial support to projects in the field of culture and education, demonstrating our dedication to the local community.

To what extent does Banca Intesa keep pace with new technologies and the digitalization of its services? Do you plan to launch new e-banking services?

Banca Intesa embarked on a comprehensive digital transformation journey in 2019 with the upgrade of its core banking platform and continued with the introduction of a new digital banking platform in 2021, with further plans to shape its approach to customer needs, expectations and current trends. We have recently introduced new functionalities within our mobile application, such as loan disbursement, cash withdrawal and PIN delivery, while continuously developing new ones that will make the lives of our clients significantly easier. Modern trends imply changes in the perception of the traditional role of the banks as purely financial institutions, so it is more than evident that we will have to change the paradigm of doing business traditionally. In order to remain relevant and stay competitive in the market, banks will have to keep pace with the habits of their customers to make their transactions invisible and seamless through the integration of banking products and services into non-banking segments, such as consumer platforms and applications, and this will be an important item on our digital agenda as well.