Eastern European nation punching 12 times above its weight

Serbia has topped a global performance index for greenfield foreign direct investment prepared by fDi Intelligence, an FT data division, as regulatory reform, low labour costs and access to the EU single market outweighed the Balkan country’s otherwise disappointing economic performance.

Seat covers leave the production line at Magna Seating, a unit of Magna International, in Odzaci, Serbia. The country has topped a global ranking for attracting greenfield FDI © Bloomberg

The index measures the appeal of countries as destinations for greenfield FDI relative to the size of their GDP. Serbia scored 12.02 in the index, closely followed by Cambodia (11.24) and Macedonia (9.18). The south-east European nation’s score indicates that in 2016 it attracted more than 12 times the greenfield FDI that would be expected for an economy of its size. This is the third year that fDi Intelligence has compiled the index. For 2016 it was expanded to include 94 countries, with four of the new additions toppling Vietnam, the index leader in the previous two years. Foreign investors announced 77 greenfield projects in Serbia in 2016, up from 57 in 2015.

More than half of the projects (53 per cent) were in manufacturing, primarily in electronic components and car parts, followed by real estate and textiles. Most investors are attracted to Serbia as an export platform rather than as a market in its own right. In US dollar terms — the basis for the calculations in the rankings — gross domestic product contracted by almost 16 per cent in 2015 and, after a weak recovery to 1.6 per cent growth last year, is expected to stagnate this year.

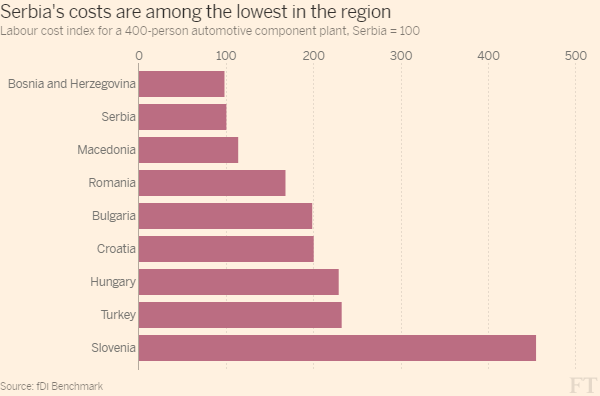

Yet the country rose seven places to 47th in the World Bank’s annual ease of doing business report for 2017, thanks in part to reforms that shortened the time it takes to register a property and deal with construction permits, and the time taken to register a company. Labour costs for a 400-person automotive components manufacturing plant are less than half of those in regional competitors such as Hungary and Turkey according to fDi Benchmark, an FT unit that compares various costs of doing business in different markets.

Serbia also has access to the European Union’s single market for its industrial goods through a stabilisation and association agreement signed in 2013. Of the 94 locations analysed by fDi Intelligence, 68 had an index score of more than 1, indicating that their share of global inward greenfield FDI exceeded their relative share of global GDP. The other 26 countries scored less than 1, indicating a smaller relative share. The index uses a methodology devised by Unctad, the UN trade and development body, for overall FDI and applies it only to greenfield FDI — leaving aside mergers and acquisitions, intracompany loans and other forms of cross-border investment.

Greenfield FDI performance index top 10, 2016

Country 2016 score

Serbia 12.02

Cambodia 11.24

Macedonia FYR 9.18

Laos 8.55

Vietnam 7.76

Myanmar 7.55

Rwanda 7.01

Singapore 6.81

Lithuania 6.62

Mozambique 6.27

Source: fDi Intelligence

Of the 10 largest economies in the world, only the UK (2.29), India (2.11) and France (1.06) had index scores greater than 1. China’s score fell by 0.03 points to 0.37; only Italy (0.37) and Japan (0.22) had lower scores of the 94 countries analysed. The US improved slightly from 0.47 to 0.5. In Africa, 14 countries made the index, of which only Nigeria and Algeria scored less than 1. Rwanda topped the African index with a score of 7.01.

A low rate of corporation tax and skilled workforce are key lures for foreign investors targeting the European market. Finland and the UK ranked second and third, respectively. The UK performed strongly in FDI terms in 2016. It remains to be seen if this trend continues into the next index with the Brexit process in full swing. Greenfield FDI data used in the index are sourced from fDi Markets, an FT data service, and exclude retail investments. The 2016 index was extended to 94 countries, all of which received at least 10 greenfield FDI projects in 2016. The 2015 figures were revised from last years’ index as further project information became available in 2016/2017. Gross domestic product figures were also revised based on more recent data from the International Monetary Fund. This article has been amended to clarify that Serbia’s GDP figures (and all GDP figures in the fDi ranking) are expressed in US dollar terms, and to correct Serbia’s 2017 ranking in the World Bank’s ease of doing business report to 47th, rather than 44th as previously stated.