Societe Generale Banka Serbia greatly improved its results in 2016. The Bank’s returns after tax peaked at 3.7 billion dinars (29.9 million euros) – up by 80 percent year-on-year, whereas its consolidated result that includes related persons Sogelease Srbija and Societe Generale Osiguranje topped 3.8 billion dinars (31 million euros), up by 73% in comparison to 2015.

This is at the same time the best business performance of Societe Generale since 1991, the year when it opened as the first bank in Serbia with majority foreign share. Furthermore, in 2017 the Bank marks the anniversary of its presence on the local market – 40 years since it opened its rep office in Belgrade back in 1977.

The consolidated balance sheet sum increased by 3.7% to 244.7 bln dinars (1.98 bln euros) in 2016, from 236.0 bln dinars (1.94 bln euros) at the end of 2015.

Loans to clients reached 168.4 bln dinars at the end of 2016 (1.4 bln euros), up by 3.6% year-on-year.

The Retail sector posts sustained growth of loans (by 11.6% in comparison to the previous year) and the Bank consolidated its position among market leaders in 2016, both on the mortgage and cash loans markets.

The Bank confirmed its commitment to the development of small companies and entrepreneurs and its assurances of large potential of this segment for the development of the local economy, by posting a strong growth of loans in this segment (+38% in comparison to 2015). The Corporate Sector remained stable in 2016, with focus on strengthening partnership with clients and tailoring the offer to their needs.

In 2016, Sogelease Srbija confirmed its leader’s position on the financial leasing market. Leadership in factoring has also been confirmed on the domestic market in 2016, with turnover growth by 26 percent in comparison to 2015.

Establishing strategic partnership with company Vip Mobile and the Centre for Technological Entrepreneurship (ICT Hub) ranked among the most important Bank projects of Societe Generale in 2016.

Societe Generale Bank, which is committed to innovation on the global and local level, has organized a series of workshops and contests for the promotion of innovation culture, including most notably the first Fintech Hackathon and Open Innovation Challenge, where participants of various profiles – online entrepreneurs, programmers, designers and employees – together developed prototypes of digital solutions in financial technologies.

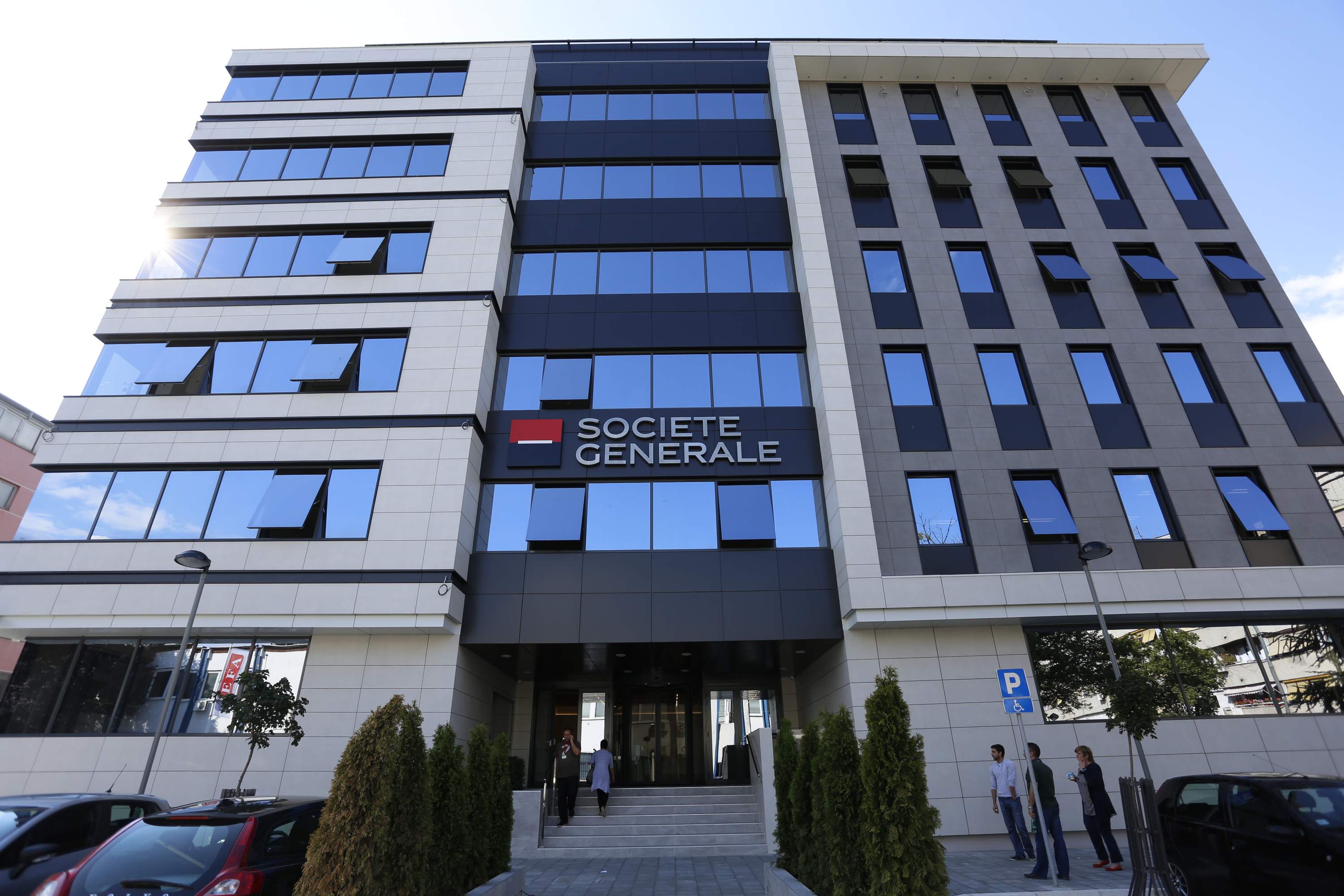

The Bank also opened its second office building in September of 2016, thereby enabling the centralization of operations and enhanced operational efficiency.